EliConnect is here to help

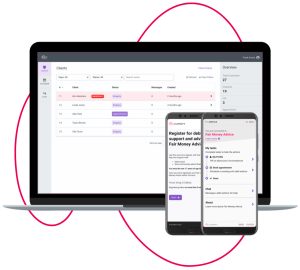

EliConnect, our digital customer engagement platform, is here to supercharge your advisors. By connecting them to the people who need support, it allows them to share genuinely helpful advice, empower long-term financial resilience and maintain your agency’s competitive advantage.

EliConnect provides you with full visibility of each end-user throughout their journey, with the data and analytics to determine the next best step. It helps you to direct your advisors’ attention to where it’s most needed, so they can focus on making a real impact with socially conscious practices.

EliConnect increases households’ emotional wellbeing by 70%.*

*Compared to traditional debt recovery methods.